What’s an effective Virtual assistant improve refinance?

The fresh new Va streamline home mortgage refinance loan is even known as the Va IRRRL. Brand new Va improve re-finance is normally an easy mortgage techniques as the the fresh individuals is refinancing from 1 Va home loan to another Va mortgage. This financing can often be referred to as Va-to-Virtual assistant Mortgage. A beneficial Virtual assistant streamline re-finance isnt available to home owners that do maybe not currently have a good Va home mortgage. The brand new Va improve home mortgage refinance loan doesn’t need that individuals inhabit our home that is currently financed with an excellent Virtual assistant home loan tool.

What is a good Virtual assistant IRRRL?

The fresh new Virtual assistant IRRRL loan is even referred to as Virtual assistant refinance and/or Virtual assistant improve re-finance. This new phrase IRRL represents interest rate refinance avoidance mortgage. Brand new Virtual assistant IRRRL mortgage or Virtual assistant improve re-finance are an alternative particular refinance loan offered from the Va Loan Warranty program. This new Va IRRRL mortgage is actually a fixed-rates refinance loan program. This financing is perfect for people exactly who now have a beneficial Virtual assistant home mortgage who’re trying all the way down its monthly rate of interest.

Might you re-finance good Va mortgage?

Sure, while already a homeowner whoever house is funded thru a beneficial Virtual assistant real estate loan you could potentially apply for a conventional, FHA or Virtual assistant re-finance. Depending on the rates and terms a borrower wants, he’s the option to review any refinance loan to change the most recent Virtual assistant home mortgage.

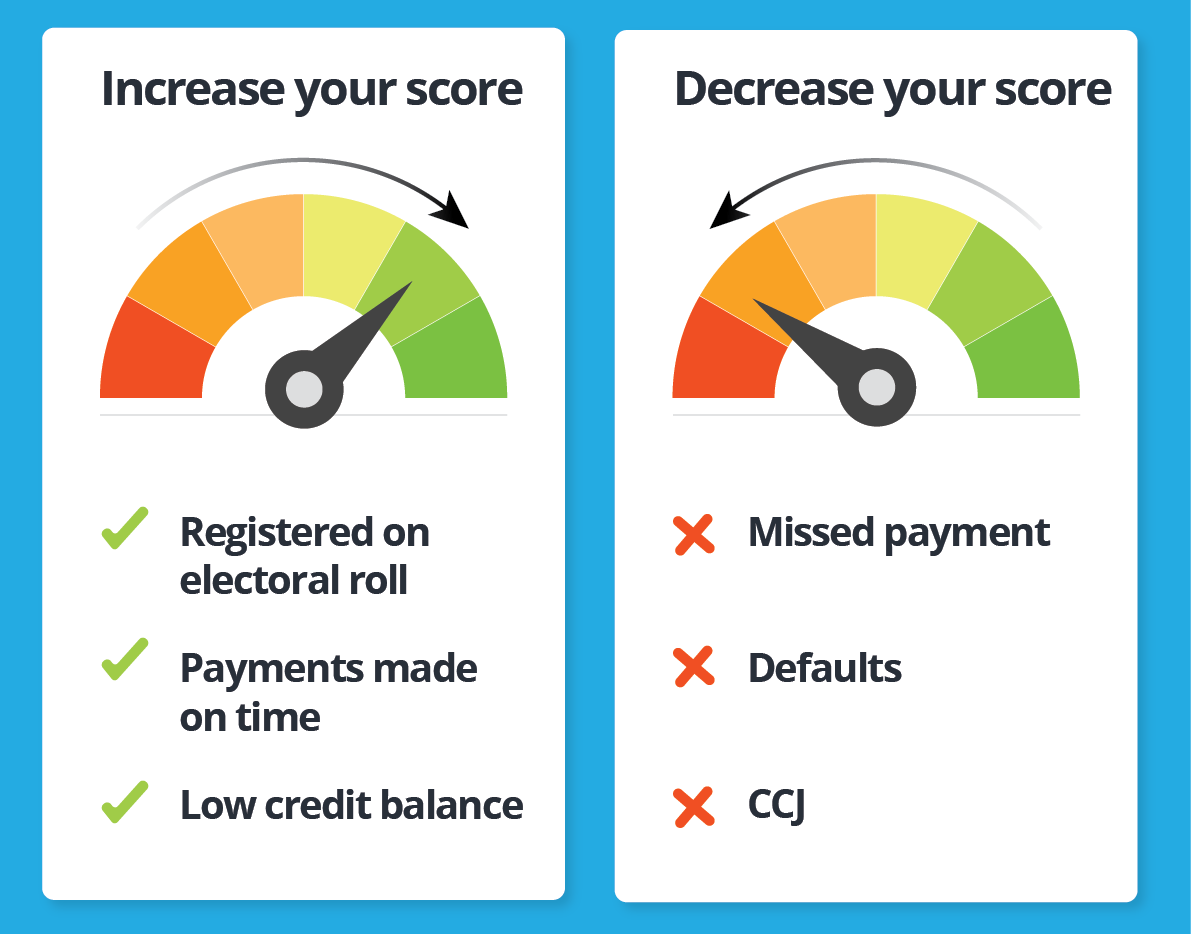

According to the quantity of chance from the a borrower, very loan providers do usually need the homeowner provides its current Va mortgage loan for a minimum of one year prior to implementing to possess a refinance. Payment record is one of the most essential products during the deciding an effective borrower’s risk level to possess an excellent Va refinance.

Must i refinance my personal financial having a great Va loan?

Sure, while you are positively serving military, honorable discharge, experienced or the surviving spouse of any of early https://availableloan.net/personal-loans-ma/ in the day which is the latest debtor out of a beneficial Virtual assistant home loan you range refinance otherwise Virtual assistant IRRRL financing. The fresh Va improve refinance or Va IRRRL financing is just offered to help you people who have an excellent Va mortgage loan. Va refinance mortgage goods are unavailable to civilians or the public.

Should i refinance a normal financing to a good Va financing?

Yes, a debtor that is entitled to Virtual assistant experts is also re-finance from a normal financing so you can a good Virtual assistant loan. Although this is maybe not regular, there isn’t any restrict one prevents which. Getting eligible for an effective Virtual assistant loan a debtor should be positively providing on You.S. armed forces, honorable discharge, experienced or perhaps the enduring lover.

When you should refinance Va mortgage?

The decision to refinance property should not be pulled gently. The crucial thing getting a citizen to check and determine the economic requirements. In the event the a resident is seeking the chance to lower their month-to-month interest rate otherwise changeover of a variable speed home loan in order to a fixed rate system, after that a beneficial refinance could be good opportunity. Speaking with a talented mortgage originator will help a borrower review their money, property, and you will personal debt to decide if the a beneficial refinance is the proper choice.

How much time will it decide to try refinance a good Virtual assistant financing?

TIf a beneficial Virtual assistant debtor uses the new Va IRRRL mortgage otherwise Va improve re-finance, the entire processes will be completed in 31 to forty five weeks. Whilst Virtual assistant streamline refinance otherwise Virtual assistant IRRRL mortgage cannot require earnings confirmation, so the fresh new Va re-finance strategy to proceed, a debtor need to have another certificates:

- Va Mortgage eligibility of one’s borrower need to have started placed on the house or property intended for re-finance

- Current 2 years off W-dos comments to ascertain income

- Ability to document current otherwise previous occupancy of the home

- Verification of currency into the mortgage repayments or no more than one later payment within the last one year